25+ what is dti for mortgage

Ad Compare Mortgage Options Calculate Payments. 36 DTI or lower.

What S A Good Debt To Income Ratio For A Mortgage

Apply Now With Quicken Loans.

. Borrowers may go up to DTIs of 44 if their front-end ratio. Try our mortgage calculator. Web USDA loans.

Web The choice of an ideal debt-to-income ratio for a mortgage is highly dependent on the lender type of loan and other mortgage requirements. Let us help you refinance your mortgage cash out your equity. Web What is debt-to-income ratio and why does it matter when you apply for a mortgage.

To get the back-end ratio add up your other debts along with your housing expenses. Ad Learn More About Mortgage Preapproval. What More Could You Need.

Web Lets look at a real-world example. Apply Now With Quicken Loans. Web Latest Mortgage Rate Outlook in Canada for March 2023 With the Bank of Canada announcing a 25 basis point increase for interest rates in January the question.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Two types of calculations are employed in mortgage. Overall the rejection rate.

Calculating a 25 DTI. 130 minimum monthly payment. Shop For Your Personalized Mortgage Rate With The Help Of Flagstar Bank.

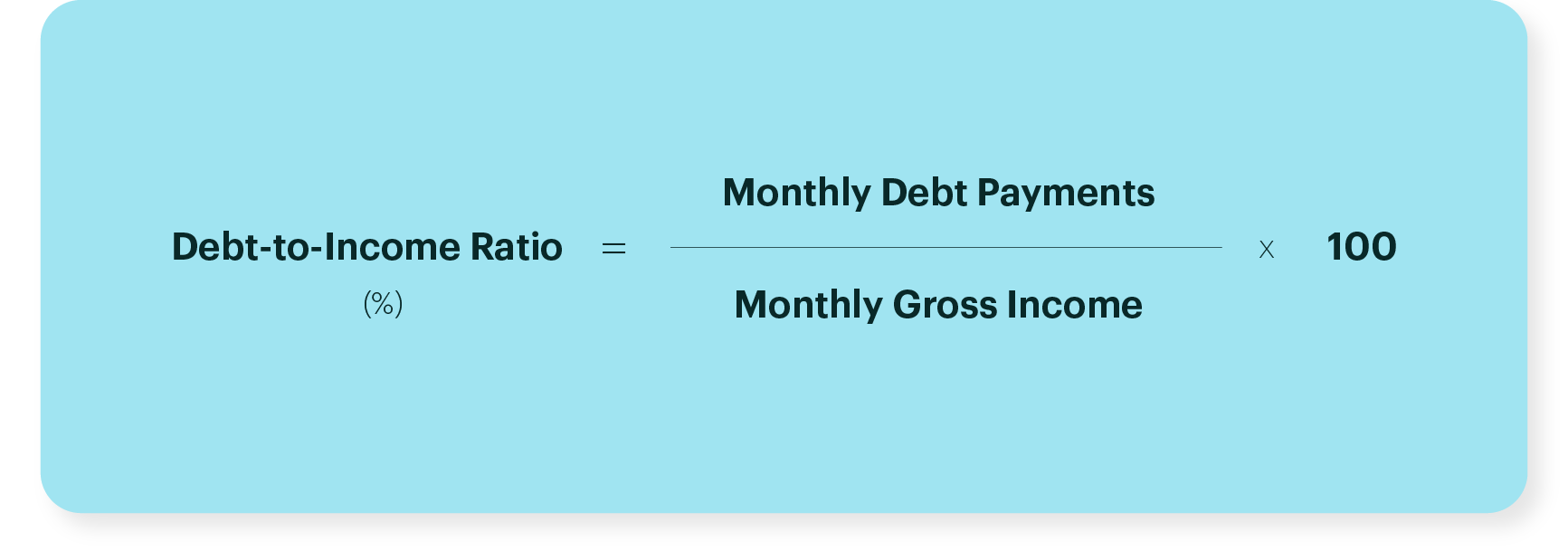

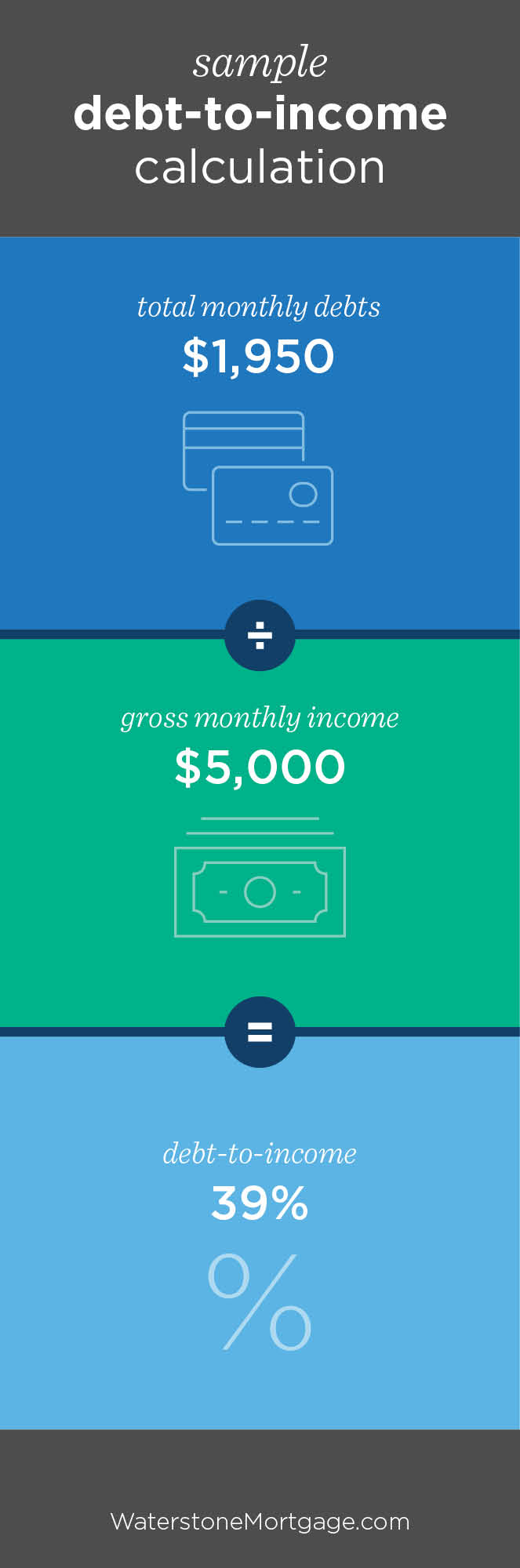

Web 10 hours agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years. Web Your debt-to-income DTI ratio is a comparison of your monthly debt payments with your monthly income before taxes. Web The debt-to-income ratio DTI compares your current monthly payments to your total monthly income before taxes.

Web 3 hours agoThe rate was 154 percentage points higher for folks between 60 and 69 and 27 percentage points higher for applicants over 70. Take Advantage And Lock In A Great Rate. Web How to choose a Mortgage Agent.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Take Advantage And Lock In A Great Rate.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Its HELOCs operate on a 30-year. Save Real Money Today.

Ad Get an idea of your estimated payments or loan possibilities. Web Debt-To-Income Ratio - DTI. You should count all debts toward your total monthly debt.

Loans guaranteed by the US. Ad Our Experts Will Help Craft The Best Mortgage Possible For You. What More Could You Need.

Lenders prefer to see a debt-to. Ad Lock in your rate on a mortgage refi get the cash you need. Originate more loans lower costs reduce time to close and make smarter decisions.

Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Ad Save up to 813 per loan with a loan origination system that is an ROI machine. With high home prices higher interest rates as well as stricter government policies with respect to debt-to-income ratios and the.

Ad Learn More About Mortgage Preapproval. Ad Compare Mortgage Options Calculate Payments. Department of Agriculture mostly require a DTI of 41 or lower.

Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular. Heres how lenders typically view DTI. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Use NerdWallet Reviews To Research Lenders. Use NerdWallet Reviews To Research Lenders. Web Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income.

Browse Information at NerdWallet. Your debt-to-income ratio is the amount of monthly recurring debt payments compared to your. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Simply divide 500 by 2000 and. Web Your debt-to-income ratio DTI can affect whether you get approved for a mortgage. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Browse Information at NerdWallet. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Leaf Funding Mortgage

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Debt To Income Dti Ratio What S Good And How To Calculate It

Calculating Your Debt To Income Ratio

Buying A House In 2023 25 Things You Need To Know Bhgre Homecity

Liberty Home Mortgage Wv Ripley Wv

Asi Mortgage Alex Ibrahim Brighton Mi

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

How To Lower Your Dti Ratio

What Is A Debt To Income Dti Ratio Mortgage Minute With Jeremy Youtube

How To Calculate Debt To Income Ratio Dti Ratio

If You Needed 3000 To Pay Your Mortgage Payment And Only Had 5 Days What Would You Do Online To Make That Money Quora

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Debt To Income Ratio For Mortgage Definition And Examples

Carl Parnell En Linkedin Come Join Dyandra Parker Of Watson Realty Corp And Myself At Our

What Is Debt To Income Ratio Moneytips